How can Private Investors benefit from Alquant?

Clear Market Risk Indicator

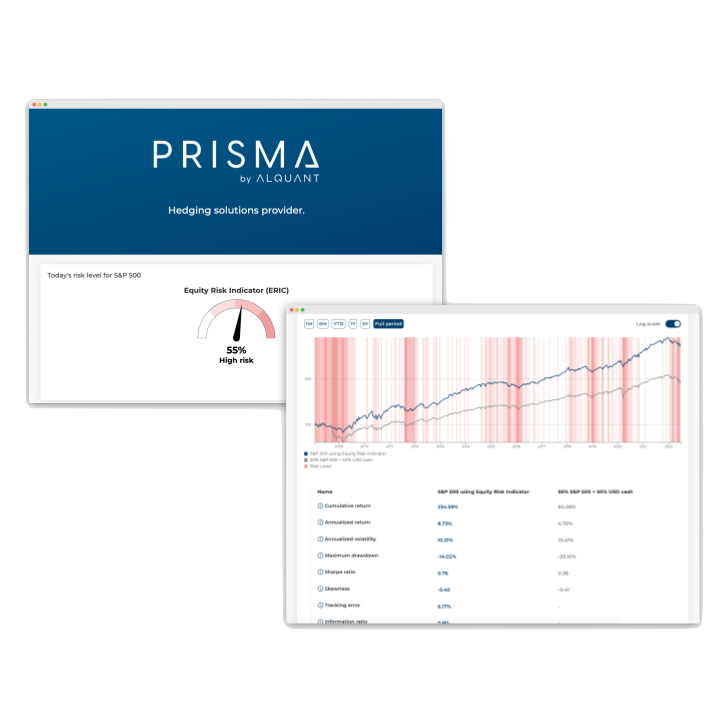

Use our Equity Risk Indicator (ERIC), which aggregates a wide range of information, in order to easily understand current market conditions and make informed investment decisions.

Ready-Made Investment Products

Easily invest in Convexus, our data-driven investment product focused on high performance and equipped with an airbag in order to better navigate periods of market drawdowns.

Get a clear and actionable market risk indicator

Your situation

Processing the voluminous and often contradictory market information available today is overwhelming and time-consuming. You are looking for a simple indicator that can help you directly understand current market conditions and make decisions about how much risk to take in your portfolio to maximize its risk-return profile.

>> Our solution

Get a clear and actionable market risk indicator

Your situation

Processing the voluminous and often contradictory market information available today is overwhelming and time-consuming. You are looking for a simple indicator that can help you directly understand current market conditions and make decisions about how much risk to take in your portfolio to maximize its risk-return profile.

Our solution

The Alquant Equity Risk Indicator (ERIC) is an advanced but intuitive risk indicator that provides a clear view about current market conditions. When ERIC indicates high risk, investors should reduce their exposure to equity to avoid unnecessary risk and ensure adequate capital preservation.

ERIC is a data-driven, rule-based indicator that is freely available and combines all the Alquant indicators into a single number. The interpretation of ERIC is straightforward: the higher the risk indicator value, the higher the potential fluctuations and the lower the average returns.

Convexus: Invest in equity with an integrated airbag

Your situation

It is always difficult to know when is the right time to buy or enter the market. Thus, you want to mitigate risk by investing in products that benefit from rising markets but still provide some buffer against losses in case of a market crash or panic sell-off.

>> Our solution

Convexus: Invest in equity with an integrated airbag

Your situation

It is always difficult to know when is the right time to buy or enter the market. Thus, you want to mitigate risk by investing in products that benefit from rising markets but still provide some buffer against losses in case of a market crash or panic sell-off.

Our solution

Convexus by Alquant is a U.S. equity fund enhanced with an advanced built-in downside airbag. Convexus empowers private investors to take full advantage of Alquant's proactive risk management directly through one investment.

Mitigating drawdowns without sacrificing too much upside is an effective way to achieve long-term outperformance. Hence, Convexus seek to significantly reduces large drawdowns while delivering similar returns to the broad U.S. equity market during market rallies.

Convexus is the perfect core equity solution for investors who want to reduce drawdowns without missing too much upside potential.