Prisma: Augment your edge with unique actionable indicators

Proprietary Indicators

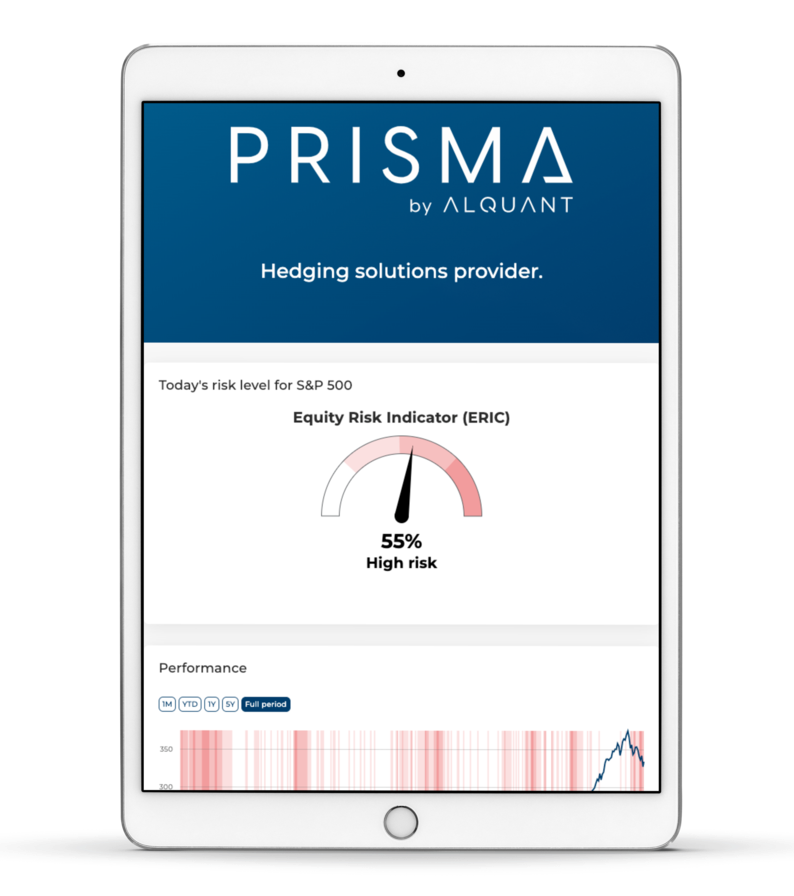

Make informed equity decisions and better distinguish between low-risk and high-risk regimes thanks to our actionable data-driven indicators.

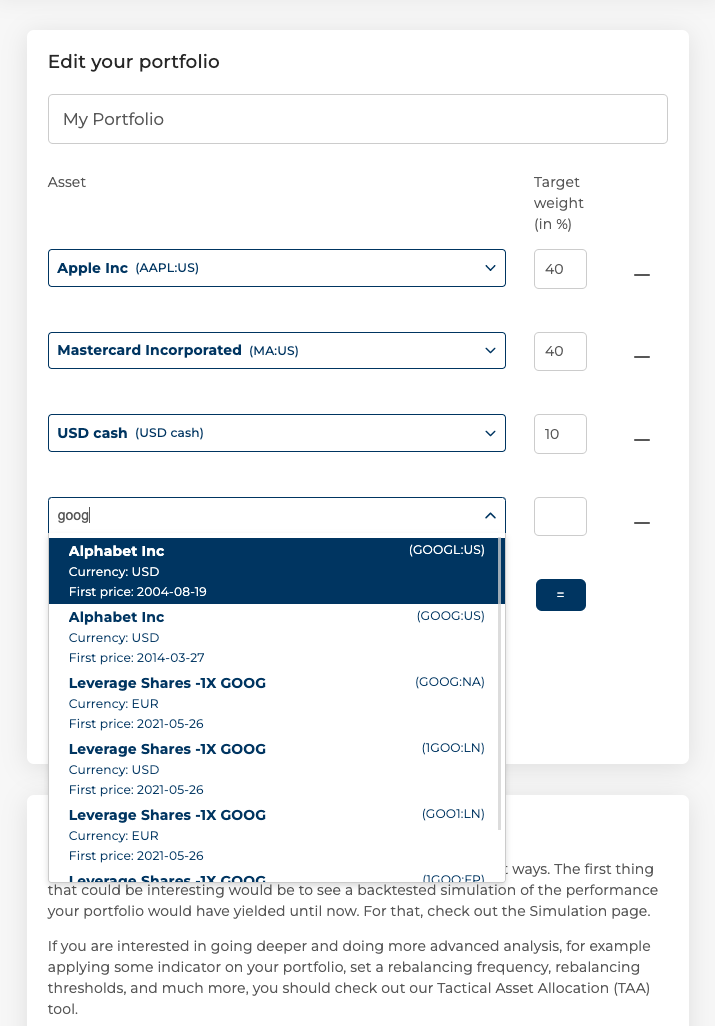

Portfolio Analysis

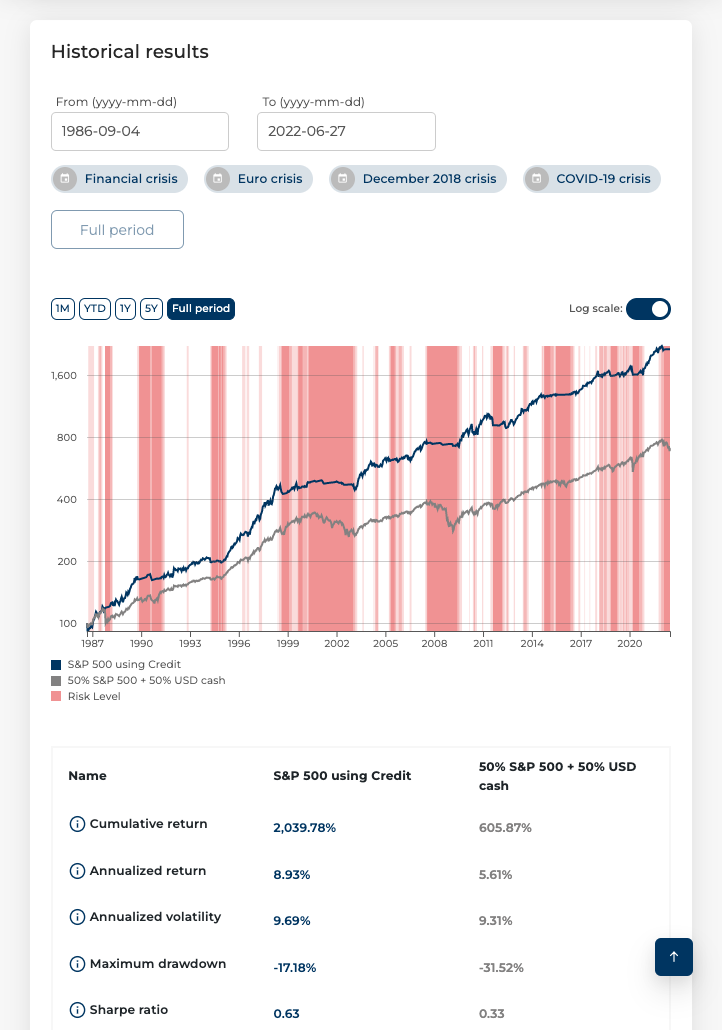

Backtest any portfolio in less than 30 seconds with just a few clicks. Assess risk and find ways to protect your portfolio or enhance its performance.

Complete Customisation

Create custom indicators that take into account rebalancing frequency and many other constraints.

Expand your investment arsenal with Alquant's data-driven and actionable indicators

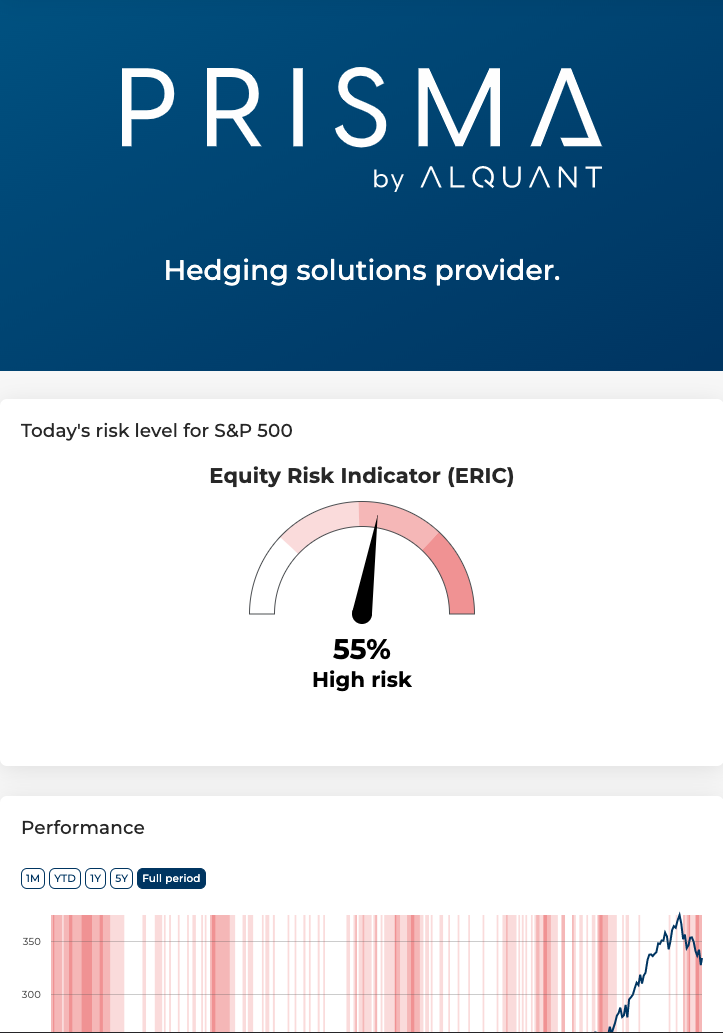

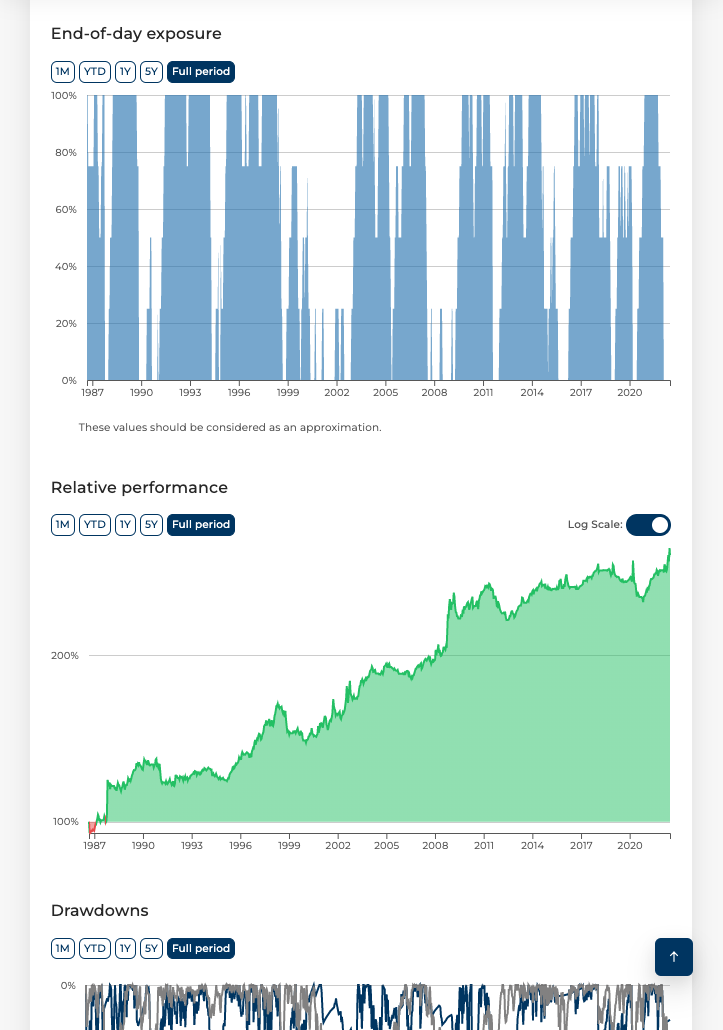

Apply Alquant's actionable risk indicators on various equity indices. Alquant's risk indicators are based on multiple data sources, which are systematically measured and translated into individual risk indicators covering various market factors. Identify market phases with low and high crash risks and allocate equity in a risk-controlled manner. Participate in favorable market phases while minimizing risk. Avoid larger losses during turbulence by systematically reducing equity exposure. Adjust risk indicators to specific investment constraints and compare the results to various benchmarks to directly analyze how they can help you reduce drawdowns and outperform in rising markets.

Create a custom indicator to stay ahead of major market risks

Combine your choice of Alquant's risk indicators to create a diversified and custom risk indicator that provides a comprehensive view of prevailing market risk and can easily be translated into portfolio actions. Further customize your indicator by deciding what weighting to give each risk indicator and analyze its performance without any coding experience required.

Stay informed

Prisma is a valuable tool for monitoring the stock market and keeping up with changing market conditions. By selecting the indicators you want to track, you can receive email notifications whenever the corresponding risk level changes. This way, you instantly know when changes happen. Hence Prisma can help you make informed decisions and keep up with ever-changing market conditions.

Create, backtest and enhance any portfolio

Prisma is designed to help you make better decisions in the tactical asset allocation of any portfolio. By creating a portfolio and backtesting it, you can see how your portfolio would have performed in the past and apply our risk indicators to make tactical reallocations that meet your investment constraints. Simply select the risk indicators you want to use and your investment constraints and see how Prisma's insights can add value to your tactical asset allocation. With Prisma, there's no need to sacrifice your investment goals to manage risk.